The Subscription Audit: How To Stop Your P&L From Leaking $29 At A Time

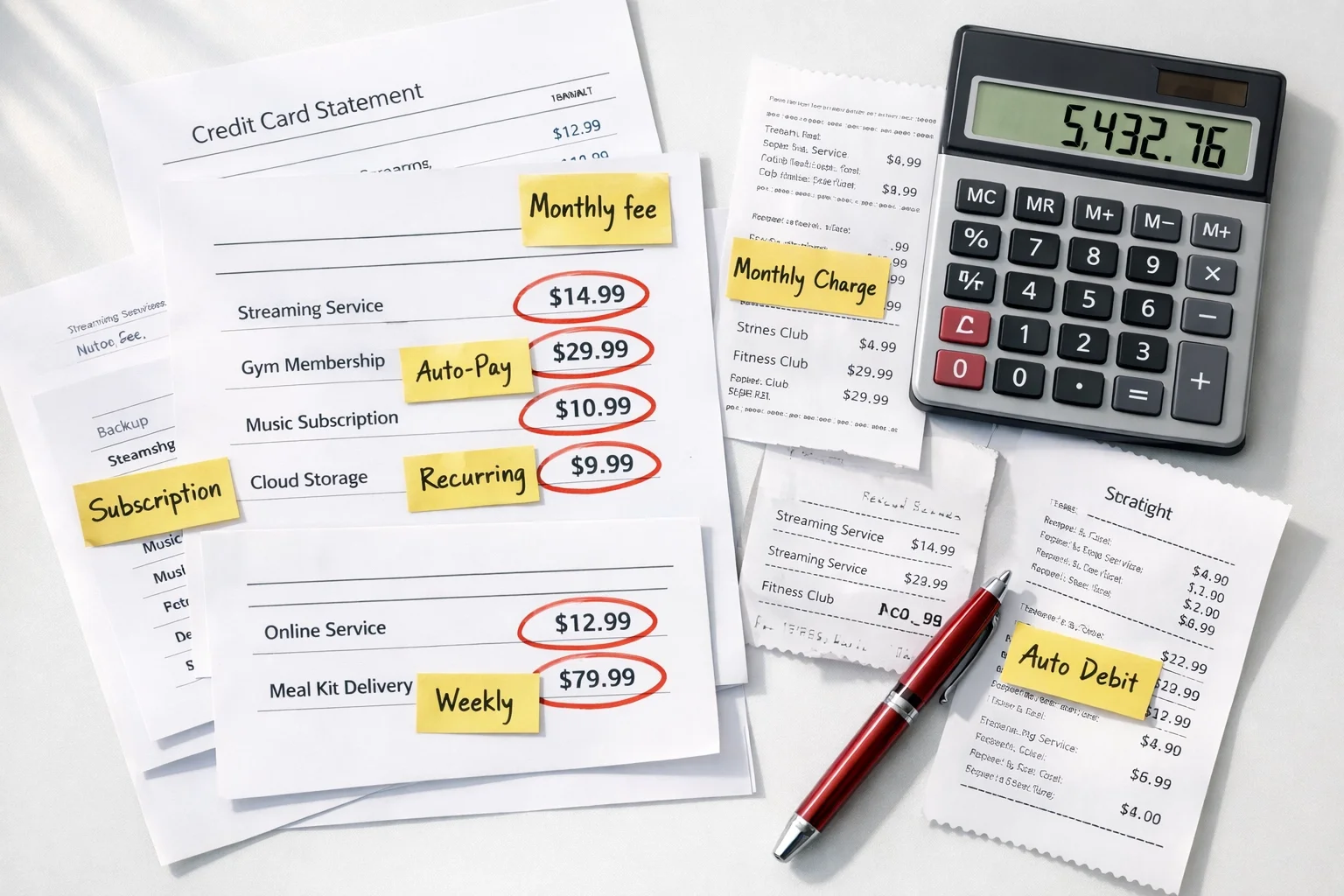

You're reviewing last month's financials and something feels off. Revenue was solid. Payroll was expected. But your profit margin is thinner than it should be—again.

You start scrolling through your P&L, and there they are: a parade of $19, $29, and $49 monthly charges. Slack. Canva Pro. That project management tool you used once in 2024. Two different email marketing platforms because you forgot you already had one. A Zoom account, a Google Workspace subscription, and Microsoft 365.

Welcome to SaaS Shadow Drain: the silent profit killer hiding in your subscription stack.

The scary part? Most business owners have no idea how much they're losing. They see a $39 charge and think, "That's nothing." But when you're paying for 15 "nothings" every month, suddenly you're down $7,000 a year on tools you barely use.

Let's fix that. Today, we're walking through a 15-minute subscription audit that'll help you find the leaks, cut the waste, and reclaim hundreds (or thousands) of dollars that should be staying in your business.

Why $29 Charges Are Eating Your Profit Margin

Here's the thing about small recurring charges: they're designed to fly under the radar. Companies want you to forget about them. It's the entire business model.

A $29 monthly subscription doesn't sound like much. Annualized, that's $348. Still not panic-inducing, right? But here is what actually happens in most small businesses:

- Slack Team Plan: $100/month (8 users)

- Canva Pro: $12.99/month (even if free works)

- Grammarly Business: $75/month (5 users)

- Forgotten CRM: $49/month (tested in Q2)

- Duplicate Storage: $20/month (Dropbox & Google)

- Zapier: $29/month (for 3 dormant automations)

- Monday.com: $39/month (never canceled after switching)

- Total Monthly Drain: $324.99

- Annual Cost: $3,899.88

And that's just the obvious stuff. We haven't even talked about the software you bought "for the team" that only two people actually use, or the tools with "phantom seats"—licenses assigned to employees who left six months ago.

One client came to us frustrated because their monthly expenses kept creeping up even though headcount was flat. We ran a subscription audit and found $6,200 in annual charges for tools they either weren't using or had better alternatives for. That's real money that could've gone toward hiring, marketing, or—wild idea—profit.

The 15-Minute Subscription Audit

You don't need fancy software or a full-day project to find these leaks. You just need 15 focused minutes and access to your bank statements or accounting software. Here's the process:

Step 1: Pull 3–6 Months of Transactions (5 minutes)

If you're using QuickBooks, Xero, or any other accounting platform, run a Profit & Loss Detail report for the last six months and filter by "Software" or "Subscriptions" expense categories.

If you're not categorizing expenses (we need to talk), pull your business credit card and bank statements. You need more than one month because some subscriptions bill quarterly or annually and won't show up in a 30-day snapshot.

Step 2: Highlight Every Recurring Charge (5 minutes)

Go line by line and mark anything that repeats. Look for SaaS platforms, hosting, communication tools (Slack/Zoom), and professional memberships. Pro tip: Don't skip the small stuff. A $4.99 iCloud charge or a $9.99 Adobe stock photo subscription still counts.

Step 3: Ask the Million-Dollar Question (5 minutes)

For every item, ask: "If this disappeared tomorrow, would anyone notice within 48 hours?" If the answer is no, it's a candidate for cancellation. Then ask: "Is there a free or cheaper tool that does 90% of what we need?"

The Usual Suspects: Common SaaS Leaks

Here are the charges that show up in almost every small business audit we run:

- The Forgotten Trial: You signed up for a 14-day test, never used it, and forgot to cancel. Now you've been paying $49/month for eight months.

- Duplicate Tools: You have Google Workspace and Microsoft 365. You're paying for Mailchimp and Constant Contact. Pick one. Cancel the rest.

- Phantom User Seats: You're paying for 12 seats, but only have 8 employees. Two of those "active" seats belong to people who left last year. You're paying for ghosts.

- Aspirational Subscriptions: You bought a $99/month prospecting tool but haven't logged in for nine months. Cancel it. You can always resubscribe if you actually start using it.

- The "We Switched But Didn't Cancel" Trap: You moved from Asana to Monday.com, but never officially killed the Asana subscription. You're paying double for the same workflow.

The High Point Perspective: Automation Finds It, Humans Decide

Here's where it gets interesting. There are tools out there that will scan your accounts, find recurring charges, and even cancel them for you automatically. Sounds great, right?

Not so fast.

Automation is fantastic for finding the subscriptions. It'll scan your bank feeds, flag every recurring charge, and calculate your annual spend in seconds. That's the part software does well. But deciding which subscriptions to keep? That requires human judgment.

Because here's the thing: not every $49/month charge is wasteful. Some tools genuinely drive value. A $79/month CRM that helps you close an extra $10,000 in sales per quarter is a fantastic investment. A $99/month scheduling tool that saves your team 10 hours a month is worth every penny.

The trick is knowing the difference between a tool that's working and a tool you're just used to seeing on your P&L.

The High Point Framework

- 1. Automation: To surface every recurring charge and calculate total annual cost.

- 2. Human Insight: To evaluate whether each tool is actually pulling its weight.

This is the exact framework we use with our bookkeeping clients. We'll flag the subscriptions, run the numbers, and then have a real conversation: "You're spending $1,200/year on this. Is it driving $1,200+ in value?" Sometimes the answer is yes. Often, it's not.

How To Keep Your Subscription Stack Lean

Once you've done your first audit, don't let the subscriptions creep back in. Here's how to stay clean:

- 1. Consolidate Payment Methods: Route all business subscriptions through one business credit card. This makes audits infinitely easier and helps you rack up rewards points in one place.

- 2. Set a Recurring Calendar Reminder: Block 30 minutes every six months (January and July are perfect) to review your stack when budgets reset.

- 3. Require Approval for New Tools: No one on the team should sign up for a paid tool without running it by leadership or your bookkeeper. This stops "shadow IT" sprawl before it starts.

- 4. Build a Subscription Inventory: Keep a simple shared doc listing active subscriptions, costs, owners, and renewal dates. It’s the difference between control and chaos.

What This Actually Looks Like In Practice

Last quarter, we worked with a marketing agency that was hemorrhaging cash. Revenue was up, but profit was flat. The owner was convinced it was "payroll creep." We ran a subscription audit and found:

- Three active CRM subscriptions (forgotten migrations)

- A $299/month scheduler replaced by a $29 alternative but never canceled

- Duplicate Zoom and Google Meet paid accounts

- Eight "trial" SaaS tools still billing six months later

- User licenses for four former employees still active

Total annual waste: $11,340.

We helped them cancel the waste, consolidate tools, and set up a monthly reconciliation process. Their profit margin jumped 4.2% in one quarter. Same revenue. Same team. Just less leakage.

The Bottom Line

Your P&L doesn't have to leak $29 at a time. The 15-minute audit isn't just about saving money (though that's nice); it's about making intentional decisions about your tools and building a business that runs on what actually drives value.

Block 15 minutes this week. Pull your statements. Run the audit. You'll either find easy savings or confirm you're running a tight ship. Either way, you'll know.

Need help tracking down subscription leaks?

We help small businesses audit their spending, clean up their books, and set up systems that catch wasteful charges before they compound. Let's make sure every dollar on your P&L is working as hard as you are.

Support You Toward Your Financial High Point